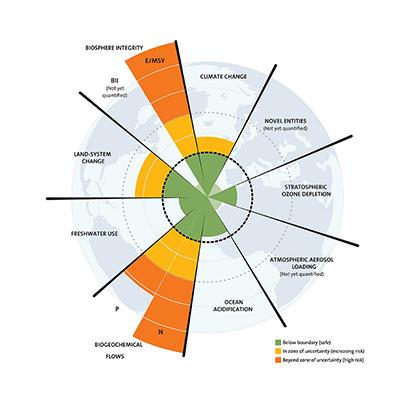

Sustainability is embedded at every stage of our investment process across all funds and asset classes. This integration is essential to managing physical, regulatory, reputational, and fiduciary risks, and enables us to build a resilient and future-proof portfolio.

Every potential investment is rigorously screened against Eurazeo’s Exclusion Policy and undergoes sustainability due diligence. To ensure compliance with our sustainability policies and the implementation of tangible sustainability actions, Eurazeo’s expectations are formalized in shareholder agreements and side letters.

Our value creation strategy for portfolio companies focuses on mitigating risks, reducing negative impacts, and advancing sustainable practices. These efforts aim to enhance operational efficiency, reduce costs, unlock new revenue streams, and ultimately support higher exit valuations. To do so, we provide operational support as well as access to expert guidance, tools, and resources to help companies succeed in their transformation. We also increasingly use sustainability-linked loans in our financing.

To ensure rigor and accountability of our approach, it is monitored annually using key performance indicators reviewed by independent third parties—reinforcing transparency and upholding the highest standards of integrity.

For more information, please refer to our Responsible Investment Policy and the chapter 3 of our Universal Registration Document (URD).